Why You Need to Diversify your Income Streams

Diversifying your income is no longer just an option; it has become a necessity for future-proofing yourself.

As Warren Buffet wisely said:

If your salary is your only source of income, you're one step away from poverty

According to a 2023 Harris poll survey, 65% of Americans are living paycheck to paycheck. This statistic should be a cause for concern for most individuals.

While it might have been acceptable in the 1950s when loyalty and stability were highly prized by both employers and employees, job tenure has significantly decreased since then. It is true that voluntary reasons such as job-hopping contribute to this trend, however, it's no secret that involuntary factors, such as layoffs due to economic downturns, performance issues, globalization, and advancements in technology, play a significant if not bigger role in destabilizing employment situations.

The reality is that your job isn’t as secure as it may seem, and for many people, this realization only dawns when change is imminent, leading to considerable stress.

Here are some ways you can diversify your income without overly detracting from your primary job:

Stock market investing

While fluctuations and short-term volatility can be daunting, the stock market is fundamentally designed to appreciate in value over time. The entry point is relatively low, making it accessible to many.

Pros: Low barrier to entry.

Cons: Can be volatile.

Real estate investing

While this requires a higher entry point, strategies like house hacking can help lower the barrier. House hacking involves purchasing a property with multiple units (e.g., a duplex, triplex, or fourplex) and living in one while renting out the others for rental income.

Pros: Real estate is a good way to leverage your money, typically requiring only a 20% down payment for a conventional primary home. With appreciation and rental income, it's an effective tool for wealth building. Moreover, real estate offers significant tax benefits. Remember, one of your biggest expenses is tax.

Cons: Higher initial investment required. Not everyone enjoys having to deal with tenants.

Digital content creation

While this option demands more upfront time investment and sweat equity, it requires no initial monetary investment. Moreover, it's a valuable skill in today's digital age, with employers increasingly considering your social presence as a quick validation of your expertise.

Pros: Free to start, and it can serve as a valuable brand currency.

Cons: Requires significant upfront effort, and results may take time to materialize.

All three options represent methods to decouple your income from your time. Achieving the freedom to pursue what you enjoy, whenever and with whomever you choose, is likely the ultimate goal for most individuals.

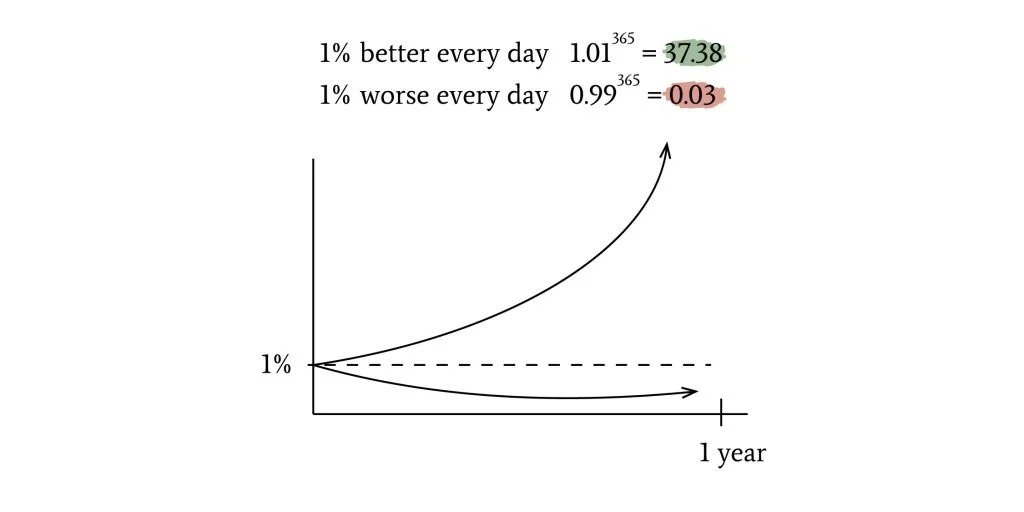

Personally, I have a lot of experience with “Stock market investing” and “Real estate investing”. While the impact may not be immediately noticeable on a day-to-day basis, the compounding effect of time proves remarkably true.

Improving by just 1% each day for a year will ultimately place you 37.38% ahead of others.

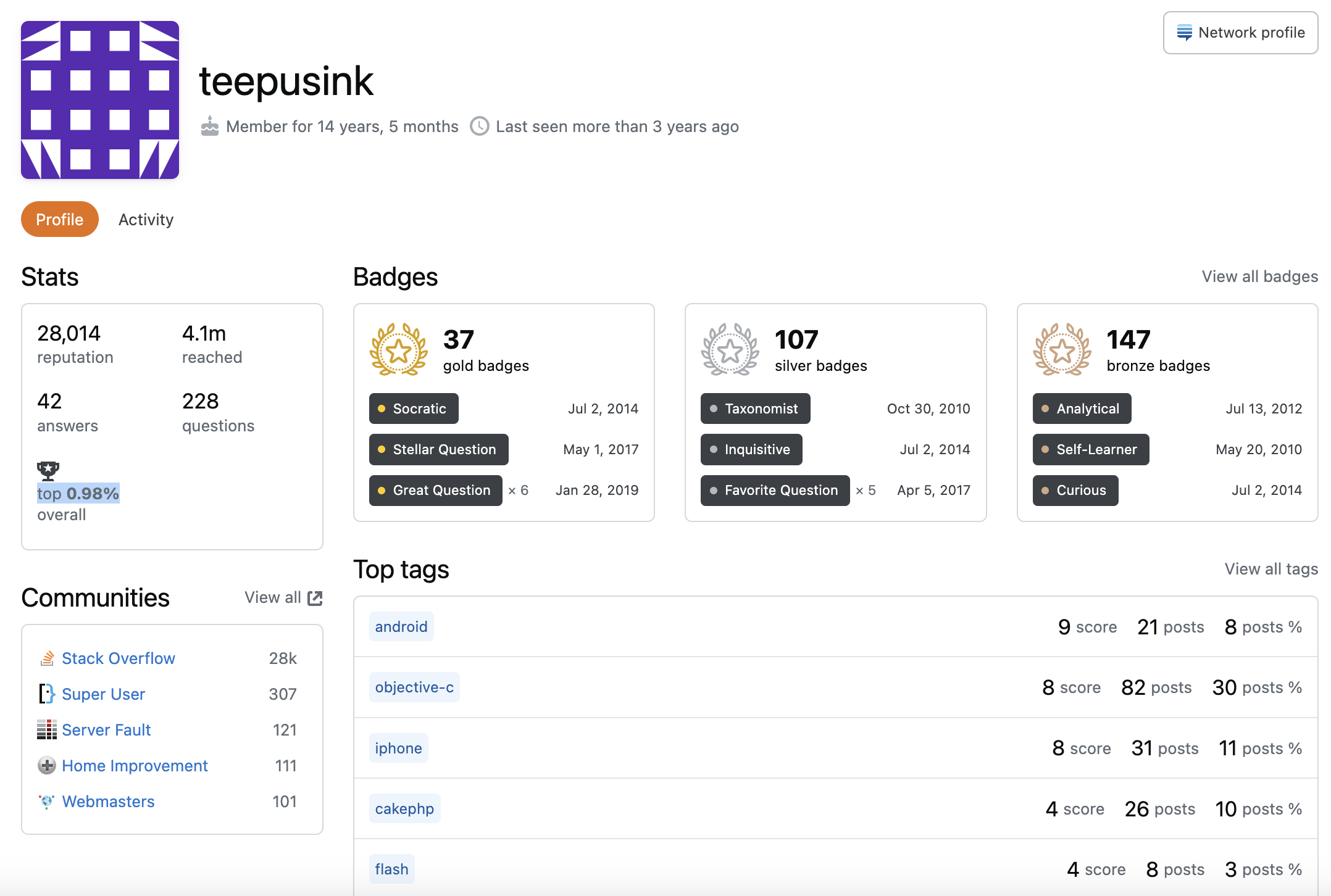

Personally, I wish I had started "Digital content creation" much earlier. I've always had numerous ideas, and people frequently inquire to me about financial topics. However, I never managed to find the time or the motivation to pursue it.

Recently, I revisited my old StackOverflow page and was surprised by the statistics. At the time I asked those questions and provided answers, I didn't believe they would be particularly valuable. Yet, it turns out they placed me in the top 0.98% overall with 4.1 million reached, despite not having been active for nearly 3 years and not having posted in at least 8 years. It highlights the power of compounding results. You simply need to take the first step.